The in vitro diagnostics industry is expected to undergo a transformation. Learn more about the potential disruptors and what IVD companies can do to keep pace.

Disruptions Form New Champions

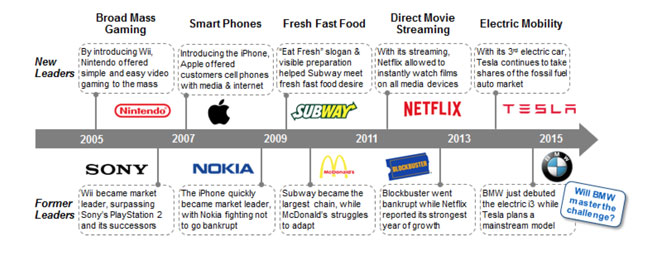

Business has taught us plenty of examples in various industries of disruptive changes that severely restructured the market order. In the course of these disruptions, many well-known market leading players did not see these changes coming and missed the opportunity to effectively adapt their strategies, business models, and portfolioses on time (see picture 1).

Picture 1: Examples of major market disruptions in the last 10 years

Consequentially, they eventually lost their market leading position to successors that were more resourceful in meeting the changed market demands. Considering the IVD market, one might wonder whether such disruption could also appear here in the upcoming years and if so, what could be learned from shake-ups in other industries.

Storm on the Horizon

IVD’s current situation looks very bright. The facts speak for themselves—solid growth of the aging population, constantly improving testing techniques, rising public interest in IVD, and the favorable financial situation among IVD players.

Nonetheless, there are market developments that indicate that the traditional IVD business model could be severely disrupted in the near future. While volume increases, margins decrease. Additionally, there is the pressure of permanent market cannibalization as empowered patients start testing themselves. IVD players do not seem to be following a clear investment strategy and new market entrants are starting to shift the playing field.

Disruption Potential in the IVD Market

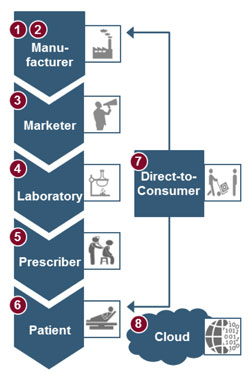

Following the market’s typical value chain helps to point out eight market changes with the clear potential to disrupt the traditional IVD market in the next years and to cause a business model imbalance to traditionally established IVD companies (see picture 2).

Picture 2: Major disruptive changes to IVD along the value chain

1. More Low-Cost Providers

Emerging low-cost providers, especially from Asian markets, slowly win market share following strict high-value/low-price strategies. This is favored by lower accepted standards of care. As soon as low-cost market players reach the accepted minimum quality standards, labs are increasingly tempted to use low-cost devices as substitutes for pricier line instruments and testing. The low-cost providers offer full-scale portfolioses with product areas spanning all IVD fields. They have competitive investment of sales into innovation and R&D ratioses (e.g., 10% of ~$1.3bn sales in 2015 for Mindray) to ensure continuous improvement and enhance customer/service experience to secure conquered market shares.

2. Non-IVD Players Joining

Non-IVD players are entering the IVD market with their own products (e.g., IBM Watson Health & Apple) or via partnerships with established players (e.g., Nestlé & AS Immune) to provide new technologies and knowledge to established healthcare companies. These new players leverage their specialist know-how for IVD (e.g., Nestlé: Protein analysis), offering alternative solutions not yet used in the IVD setting (e.g., Apple: ResearchKit and CareKit). As a result, high throughput tests could be shifted towards new instrument channels. An example is the smart contact lens by Google in cooperation with Novartis that aims to constantly measure diabetes patients’ glucose level; additionally Google engages in partnerships with Johnson & Johnson as well as Dexcom and Sanofi, demonstrating its clear ambition to enter the medtech market. As these new non-IVD players are multi-billion revenue companies, it can be expected that they have the necessary stamina to push their innovations into the market and cause significant disruption.

3. Aggressive Price Erosion

Aggressive price erosion in the form of brutal price wars is triggered by tender competition worldwide among group purchasing organizations, hospital chains, networks, and associations. Companies aim to meet customers’ reduced budget demands during the tender process through cost cutting. The erosion, however, causes customers to reject higher prices in future, fixing price expectations. Therefore, the main strategy is to win the tender now, because the next tender will be much lower. This results in highly-competitive price battles between companies, where large firms use their superior brand name to win bulk tenders, driving testing prices down and affecting all players. This development is flanked by significant reimbursement cuts—as seen blatantly with test strips for diabetic blood glucose monitoring—that withdraw substantial value from the IVD market.

4. Testing Cannibalization

Labs more frequently replace older techniques with new methods, creating testing cannibalization with shorter product life cycles. Examples include mass spectrometry, which replaces immunoassays wherever high precision and reliability is required, or molecular diagnostics, which is becoming the standard for oncology & infectious disease. Additionally, next generation sequencing (NGS) gains in importance, not only for research but also for diagnostics. In this respect, liquid biopsy is aiming to become a standard procedure for early detection and monitoring of cancer. The success of liquid biopsy and NGS is currently still outstanding due to the enormous data generation and the complexity in interpretation. Dedicated specialists for data handling are still needed. Nonetheless, these new and advanced methods provide higher sensitivity for testing, more reliability, and improved accuracy, for results with fewer false positives.

5. Innovative Treatments

Breakthrough treatments in pharma reduce the need for diagnostic tests. In some instances, fewer potential interaction effects (e.g., direct oral anticoagulants such as Bayer Xarelto) reduce the necessity for companion tests, while in other cases, the reduction in side effects require less frequent or no control/ monitor testing of patients (e.g., coagulation monitoring). New treatments also offer complete cures to viruses (e.g., Gilead Harvoni for HCV therapy). Even though initially more diagnostic tests are necessary to evalsuate the impact of the new treatment (e.g., HCV), it can be expected that the boom will quickly dissipate to a significantly lower diagnostic testing level than before the introduction of the treatment. Therefore, doctors see patients less (i.e., lower expert load) and reduce the need for lab services.

6. Empowering mobiles Devices

mobiles health is empowering patients with multiple parameters (e.g., glucose, ketone) for direct testing without the lab (e.g., Abbott Libre), yet including direct patient support. More specifically, new mobiles technologies allow for mobiles phoness and other devices to utilize photometric methods to enhance care (e.g., CellScope Oto) and act as point-of-care testing devices, thereby replacing classic lab services. This way, patients have more control over their testing and therapy and the mobiles integration allows patients to screen test results (e.g., Dario) or use integrated mobiles apps (e.g., Sanofi iBGStar, Apple CareKit), increasing convenience and possibly replacing certain physician office visits.

7. Cutting the Central Lab

Direct access testing (DAT), a direct-to-consumer model not using common devices can be done at convenient places for the customer, such as their home. Despite the very negative developments with Theranos, there is a high probability that other companies that continue advancing fingerprick blood testing will gain FDA clearance. These market players (e.g. DMI—DNA Medical Institute, Genalyte) will offer a complete value chain and establish immediate services, cutting the need to visit the doctor or lab for diagnostic testing. This is achieved through the use of nanotechnology, which can perform the work of an entire laboratory in one device. The reduced testing costs and consumer investment are then transferred to service prices. As an alternative to DAT, new IVD manufacturers are also aiming to gain CLIA-certified laboratory status. An example is Clinical Genomics, with its blood test to diagnose colorectal cancer at the earliest, most treatable stages, including post-surgical monitoring of colorectal cancer recurrence. Recently, Clinical Genomics announced its implementation of a CLIA laboratory, allowing for rapid commercialization of the new diagnostic devices and reducing the importance of central labs.

8. Cloud Diagnostics

Data processing capabilities are bringing IT companies into the game as health care players. By integrating patient records in the cloud, all diagnostic and therapeutic information can be accessed simply by physicians and patients with online devices (e.g., Flatiron). Results from different diagnostic technologies are analyzed for patterns, rather than using the separate results. By integrating big data, cloud diagnosis and the resulting therapy can be defined based on similar cases (e.g., Enlitic) to derive the correct medical treatment. Such automated, IT-based diagnostic information is making differential diagnostics redundant and reducing the importance of labs and instrument manufacturers for diagnostics.

Prepare for Change

Overall, these eight identified changes are already present and their disruptive power will continue to increase. Of these, two have the potential to transform the market for IVD high-throughput connected instruments: 1) Non-IVD players that are entering IVD via partnerships or their own products, shifting high throughput tests towards new instruments/ channels, and 2) new diagnostic device manufacturers cutting out the central lab by DAT, using not common devices, or gaining CLIA certification for their own laboratories to rapidly commercialize their devices and reducing the importance of central labs.

Coping with these changes will be a challenging task for established IVD companies. To avoid being surpassed by other companies, as has happened to many market leaders in other industries that missed such disruptions, the leading IVD companies should prepare early for change and create an adequate defense strategy. This means that traditional IVD providers need to assess their position, evalsuate the consequences of change, and define the new roles they want to play in the future. This will entail creating, evalsuating, and selecting a new or adapted business model that incorporates market changes in order to benefit from this turbulent time.